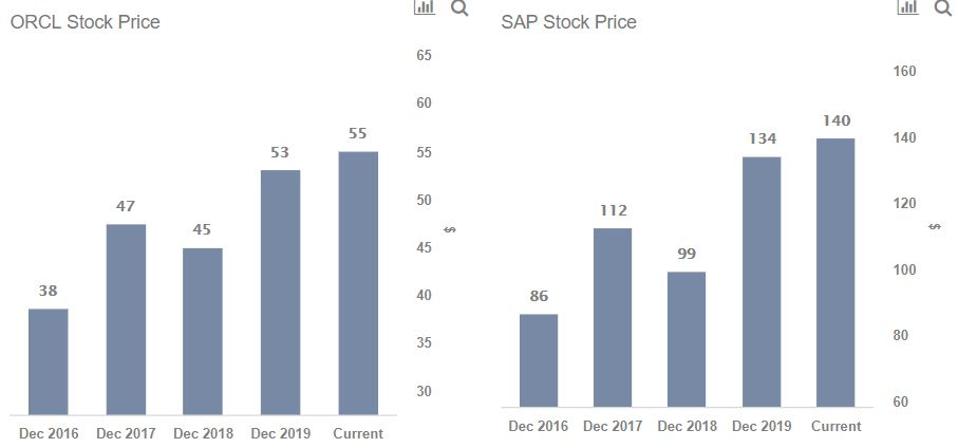

Oracle’s stock (NYSE: ORCL) is up by more than 40% since December 2016. In comparison, close rival SAP’s stock (NYSE: SAP) has grown at a higher rate of over 60% during the same period. This, despite the fact that Oracle has a larger revenue base and a more profitable business than SAP. We believe that the stock price movement makes sense and our dashboard SAP vs. Oracle: Does The Stock Price Movement Make Sense? has the underlying numbers.

Sure, Oracle’s net income margins have remained largely above SAP’s, but the key element here is the revenue growth. Despite Oracle’s revenue base being higher than SAP’s, SAP’s revenues have increased by 26% from $24.4 billion in 2016 to $30.6 billion in 2019. This is much higher than the 4% increase in Oracle’s revenues during the same period from $37.7 billion in FY2017 to $39.1 billion in FY2020. While SAP saw a dip in Net Income margin in 2019, that was primarily due to a one-time restructuring expense of around $1.2 billion and we expect SAP’s margin to recover in 2020.

Note: We have compared the fundamentals of both companies for the last 4 years (FY2017-2020 for Oracle as it follows May ending convention while 2016-2019 for SAP’s as it follows calendar year)